Travel Insurance

Travel Insurance to keep you travelling.

Travel insurance to keep you travelling, no matter what the world throws at you

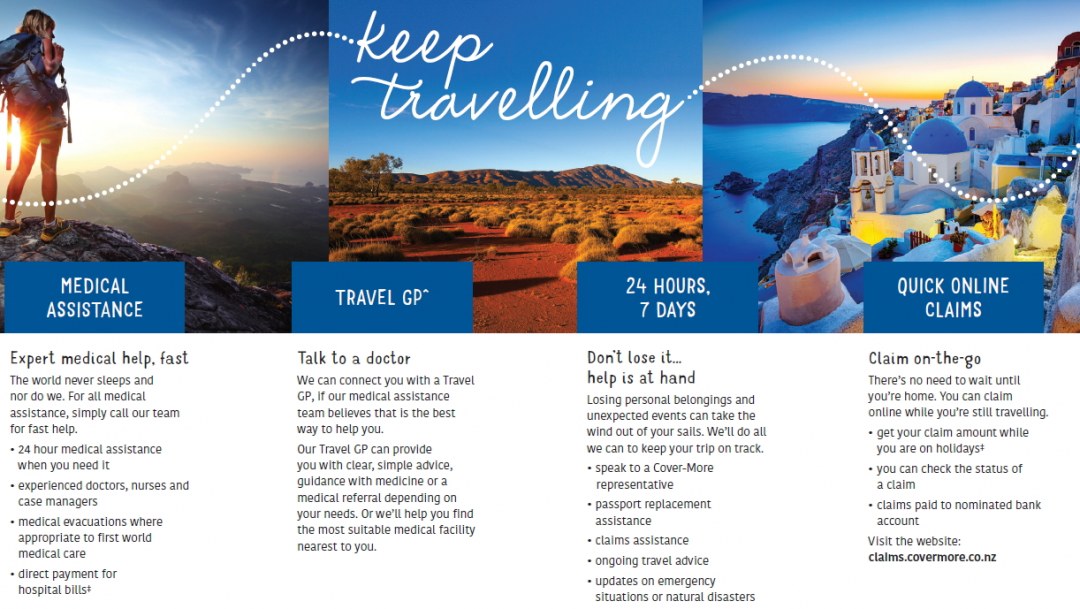

We've chosen a partner to help Kiwis fly. With quality Travel Cover comes peace of mind and the freedom to venture virtually anywhere in the world with confidence, knowing you'll have support and assistance whenever you need it. Cover-More have more than thirty years of experience and cover more than 3.8 million journeys every year. If something goes wrong, we know you'll want expert help and fast, the best possible medical care and to stay connected with friends and family. Whether it's for business or pleasure, before you explore the world, explore the cover options by Cover-More. Click on the link below to indulge your spirit of adventure and get an instant quote.

FAQ

Why has ClickCover partnered with Cover-More?

We've researched the travel market, so that you don't have to. We believe that Cover-More is the most trusted travel insurance provider available.

Cover-More have been operating in New Zealand for more than 30 years. They offer high quality cover and have an outstanding claims record (meaning their likely to pay out should you need it!).

We’re happy to stand behind Cover-More, knowing they’ll protect our clients on their journeys – wherever that may be.

Why do I need Travel Cover?

What if you were travelling through the intrepid back blocks of South America and contracted a serious illness? Would you be able to afford your medical bills?

Or what if you urgently needed to come home from a trip to Australia due to a serious family illness or death? Would you want to pay the last minute flight fees and forgo all your prepaid holiday expenses you couldn’t enjoy, such as accommodation, rent-a-car bookings or that pre-paid Movie World pass?

Travel Insurance will cover you if any of the above happen, and more. Making sure you can enjoy your holidays without worrying about the unexpected.

When should I get Travel Cover?

Any time you travel overseas, be it short or long term, near or far, you should get Travel Insurance. Your usual insurance policies will only apply to New Zealand, so if you get into trouble overseas, your existing insurance policies may not apply.

If you are travelling within New Zealand you don’t need to get Travel Insurance, but you may like to get flight insurance, which will protect you if your flight is delayed, cancelled or changed for whatever reason (wind in Wellington maybe?!). The easiest way to get flight insurance is to get it direct when you purchase your flights.

What does Travel Cover protect me for?

There are a few different types of policies – so there are some differences. But generally, most travel insurance policies will cover you for:

- Any medical costs you incur

- Emergency evacuation costs

- Theft, or loss of any person items (including your passport and money)

- Loss, delay or theft of your luggage/belongings

- Flight delays or cancellations

- Disablement or death

- Personal liability, such as an injury or loss you may have caused.

What doesn’t Travel Cover protect me for?

The devil is in the detail, and we recommend you thoroughly read and understand your Travel Insurance document. Ask us if there is anything that you don’t understand, so you can understand what is and, sometimes more importantly, what isn't covered.

As a general rule, most Travel Insurance providers will not cover you for any pre-existing medical conditions that you have. Most policies will also not cover you if your accident or injury occurred; while you were drunk, under the influence of drugs or doing something criminal.

In addition to the above, you may not be covered if you travel to a destination that is considered an extreme risk by the New Zealand Government. You can find the countries currently on the extreme risk list at www.safetravel.govt.nz/travel-advisory-risk-levels.

Most “extreme” sports and activities such as skiing, snowboarding, bungee jumping and even scuba diving are also not covered under a standard policy – so it’s important that if you’re going to partake in these activities while you’re away, that you choose a policy that specifically covers these activities.

What information do I need to tell Cover-More when taking out cover?

It's important you tell your insurer about any pre-existing medical conditions, as non-disclosure can mean that your claim is declined.

Even if your medical condition is under control, you still need to tell your Travel Insurance provider. If your condition has been managed successfully for a period of time, you may not face a higher premium, but it’s important you tell the insurer this information and let them make that decision.

What is the difference between Individual and Group Cover?

There are two main types of Travel Insurance in New Zealand; Individual Cover and Group Cover.

Individual Cover policies will only cover the policy holder (generally you).

Group Cover policies will cover a group or family that is travelling together. Group Cover will usually work out cheaper than individual cover, as the cost and risk is spread out over a number of people.

Some Travel Insurance providers offer special cover for different types of travel/travelers, such as students and adventurers, or for those partaking in overseas business or a cruise.

Do I need to have my Travel Insurance Policy with me at all times while travelling?

Most Travel Insurance providers will give you a toll free number you can call from anywhere in the world if you need to access your policy. It is important you keep this number with you at all times, as well as your travel policy number.

We also recommend you keep a copy of your Travel Insurance Documents with all your other travel documents, as you may need to show this to certain authorities in the course of your travels.

How do I lodge a Travel Insurance claim?

Save time and lodge a claim online using Cover-More's Claims Centre at claims.covermore.co.nz. You can lodge a claim here from anywhere in the world.

You will be asked to describe the incident, include medical expenses and upload supporting documentation. You can save and return to complete a claim for up to 28 days.

Alternatively, you may download and complete a Claim Form from Cover-More's Claim page and send it in. When filling out the form, take care to provide as much detail as possible regarding the event you are claiming for.

If you are in need of assistance when completing your claim, contact Cover-More Claims Customer Service on 0800 600 115 or email inquiries@covermore.co.nz

For more information, see Cover-More's step-by-step guide to making a claim on their website.

Why does Travel Cover have an excess if you make a claim?

Most Travel Insurance policies will require you to pay some money when you make a claim (commonly referred to as an 'excess'). By asking you to bare some of the cost in the event of a claim, Travel Insurance companies can keep their premiums low and cost effective.

The amount of excess varies between Travel Insurance providers and between the types of claim you are making. Excess amounts are set out in your policy.